Introduction

The directors present their Annual Review for the Zenith Automotive Holdings Limited group of companies (the ‘Group’ or ‘Zenith’), for the year ended 31 March 2021.

Zenith is the UK’s largest independent vehicle asset manager, with approximately 150,000 vehicles under management, across all asset types, including cars, vans, trucks and trailers. Zenith is also the largest independent (i.e. not bank- or manufacturer-owned) vehicle leasing business in the UK, providing a variety of leasing and fleet management options for its customers, be that corporates or consumers.

Zenith has leasing and asset management capabilities across corporate, commercial and consumer sectors; asset types ranging from motorbikes to cars to light commercial vehicles to heavy goods vehicles and specialist assets such as trailers; and leases ranging from durations of one day to eight years and beyond. Originally established in 1989 as a specialist provider of bespoke fleet solutions for mid to large corporates, its customers now range from household brands and some of the biggest organisations in the UK through to individual consumers via our rapidly growing digital-to-consumer personal contract hire channels

Across all of these innovative and intelligent vehicle solutions, Zenith provides a variety of services, from funding corporate cars, light or heavy commercial vehicles, providing flexible benefit schemes; funding cars for private consumers or delivering fully outsourced fleet management services. We have been successful for many decades in delivering a high-quality and innovative service to our customers.

CEO statement

2020 was unlike any other year in living memory. The global pandemic brought with it many unprecedented challenges, and we continue to experience the impact of COVID-19 as we enter the second half of 2021. Against this backdrop, I am incredibly proud of how the Zenith team navigated the hurdles presented by the pandemic and how they continued to deliver for our customers throughout and, in doing so, delivered such a strong performance for the company.

Our priority is – and always has been – the health and wellbeing of our colleagues and to deliver for our customers. Zenith’s three decades of experience means we had robust business processes in place coming into the pandemic. And our strong track record of investment in technology and people ensured that, by March 2020, we were able to adapt to homeworking very quickly, two full weeks before the Government instigated its first national lockdown.

Thanks to these strong foundations, we were able to continue to offer the very high levels of customer service and support that we are known for. That we were able to do so at a time when our customers themselves were going through such upheaval and uncertainty is testament to the dedication, patience and resilience of the Zenith team.

Throughout the year we continued to invest and innovate, with ZenAuto being a particular area of focus for us as our digital, direct-to-consumer offer goes from strength to strength. But that investment has also been in our people. Our commitment to investing in the next generation of the Zenith team continued apace, with 11 apprentices joining us during the period. We also signed up to the Kickstart scheme to offer opportunities to 16-24 year olds from our local community to build their careers in the automotive industry.

As we begin to emerge from what is hopefully the last significant phase of restrictions and I look across the business, I see a company that is in as robust a shape as ever.

The pandemic brought with it significant headwinds but, as a Group, we remained active during the period. In September 2020 we completed the acquisition of the fleet services, rental and finance operations of the Cartwright Group from administrators. The deal saved 259 jobs and secured Zenith’s position as the UK’s largest HGV and specialist fleet operator, with 50,000 vehicles and one of the largest trailer rental fleets in the country.

From a financial perspective, I am pleased that we have not only maintained our position but, with the inclusion of Cartwright, we grew our EBITDA on the prior year by £2.0m. That represents a rise of 3.4% to £58.1m and is ahead of our own budgetary expectations.

Most heartening has been the progress we have made during the year on the delivery against our commitment to help the UK speed up its transition towards electric transport. Zenith’s own company car fleet will be EV-only by 2025 and we have targeted 2030 as the year when all of our funded car fleet will be zero emission. Within the company itself, Zenith’s greenhouse emissions fell by 48% during the year to 305 tonnes of CO2e and, through carbon offsetting, I’m thrilled that we have been recognised by Carbon Footprint as being a carbon neutral business this year too.

The urgency of the shift towards net zero has only gathered pace over the course of the past year. Businesses large and small are coming under increasing pressure to report their emissions and investors are increasingly using ESG-related data to inform their decisions on who to invest in. And thanks to our deep experience and track record of helping our customers manage and optimise their fleets, we are ideally placed to give our customers the advice they need to help them chart their own courses as they transition from combustion engines to electric and alternative fuels.

While there are necessary and important conversations happening about the future of work, I am convinced that, whether it’s an office, production plant or distribution centre, the workplace will continue to be an integral part of people’s working lives. But regardless of whether people are shifting en-masse to two or three days a week in the office, they will still need to get to work on those days. And with the pandemic front of mind, travelling in the safest way possible will remain a priority for many, with cars offering the greatest peace of mind in that respect.

As we look ahead, I am honoured to be part of a resilient business that is leading the charge in the categories in which we operate. We have grown while continuing to perform robustly and our relationships with our customers continue to strengthen.

I and the entire Zenith team look forward to the coming year with confidence.

Tim Buchan, Chief Executive Officer

27th August 2021

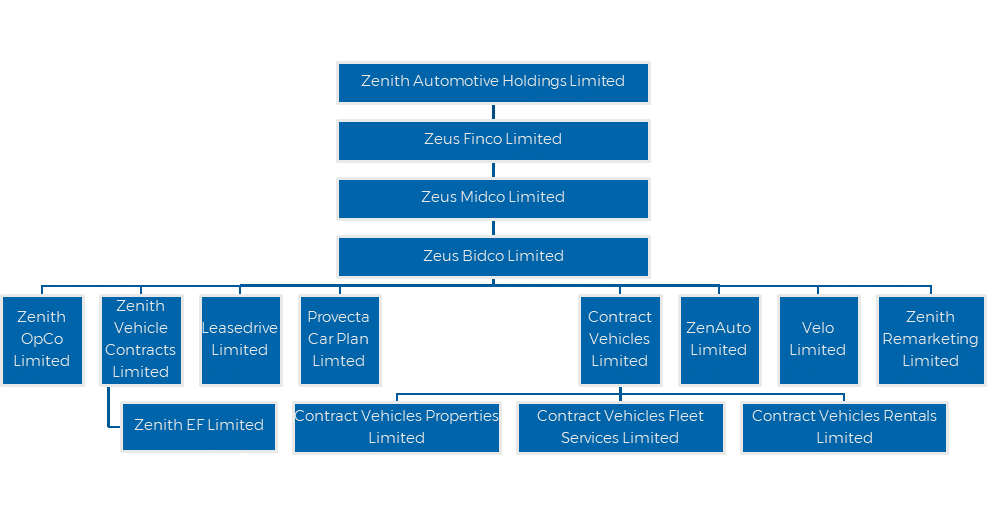

Ownership

The group structure is set out below. Each company in the structure is 100% owned.

Exhibition Finance plc (formerly known as Bifurcate Funding Limited) and Vehicle Titleco Limited are also consolidated into the Group within these consolidated financial statements. These two companies form part of the legal structure under the securitisation facilities used to provide vehicle funding to the Group but are not owned by the Group.

Zenith Automotive Holdings Limited is owned 27% by management and 73% by BEV Nominees Limited, a Bridgepoint company. BEV Nominees Limited is owned by a number of limited partnerships comprising the Bridgepoint Europe V Fund.

Bridgepoint is a major international alternative asset fund management group, focused on the middle market, providing private equity and private debt lending solutions. Bridgepoint focuses on acquiring or investing in businesses with strong market positions and earnings growth potential where significant additional value can be created through expansion and operational improvement. With c.€26 billion of assets under management, Bridgepoint invests internationally in six principal sectors: business services, consumer, financial services, healthcare, medtech & pharma, manufacturing & industrials and digital, technology & media – via a platform of offices in Europe, US and China.

Business model and activities

Historically, Zenith focused on the company car and light van fleet sector for corporate customers, but developments (via organic growth and acquisition) over recent years have added capabilities across all asset types, service offers and funding options. This includes business-to-business (B2B), business-to-consumer (B2C) and business-to-employee (B2E) services.

In terms of asset class, this means supporting everything from business-critical fleets to consumer cars and from the largest heavy goods vehicles, through to light commercial vehicles, motorbikes and the smallest city car. This opens up a significant proportion of the UK’s c. 40 million vehicle parc as our addressable market.

Zenith manages a fleet of approximately 150,000 vehicles and focuses on:

- Serving blue chip corporate customers with fleets of usually over 100 vehicles, across business fleets and salary sacrifice schemes principally on a fully outsourced and sole supply basis;

- Serving commercial customers with business-critical HGV and specialist vehicle fleets;

- Serving consumers through the ZenAuto and ElectricAuto brands providing personal contract hire (PCH) vehicles.

Key elements of our business model which we use to deliver success in our market are:

- Zenith is the leading multi-asset vehicle funder and manager in the UK, providing mobility as a service (MaaS) ranging from one day to eight years or longer;

- Zenith has over 30 years of experience and over 1,000 employees. Vehicles and drivers are kept legally compliant and mobile 24 hours a day, 365 days a year;

- Zenith’s consumer brands, ZenAuto and ElectricAuto, have continued to grow strongly during the year and deliver Personal Contract Hire (“PCH”) direct to the consumer market;

- Zenith acquired the fleet services and trailer and specialist rental operations of the Cartwright Group during the year. In combination with our existing commercial vehicle business, this created the UK’s largest HGV and specialist fleet with over 46,000 vehicles and one of the largest trailer rental fleets in the UK, as well as a network of workshops, depots and mobile technicians to support our customers;

- Zenith is leading the transition by our customers away from fossil to electric and alternative fuels;

- Zenith’s independence in ownership and funding relationships enables it to be agnostic to vehicle makers or funders, and provide the full range of vehicle and financing options available;

- Zenith’s comprehensive model, in addition to vehicle leasing and fleet management operations, includes short-term hire and business process outsourcing on behalf of long-term partners.

Zenith’s services include provision of vehicle funding, vehicle maintenance, fleet management, accident management, business process outsourcing, short-term hire and fleet consultancy, with bespoke packages tailored to customer requirements.

Mission, vision and strategy

Zenith’s mission is to decarbonise the UK vehicle parc by eliminating tailpipe emissions.

Zenith’s vision is to be the benchmark by which quality service is measured within our industry. Zenith will make a difference to society through a strong Environmental, Social and Governance (ESG) agenda and a transition of the existing funded car fleet to carbon neutral by 2030. Zenith will own the new and used consumer personal contract hire (PCH) sector; the company car and salary sacrifice sector; and the HGV and fleet management sector. Zenith will become a Top 100 company in The Sunday Times Best Company ratings. Zenith will also provide shareholders with the returns to encourage continuous investment in our business.

The Group vision is designed to be simple in its nature and to signpost the future intentions of the group, alongside guiding the core business strategy, as follows:

1. Embed ESG at the centre of our culture

- Develop both ESG and decarbonisation roadmaps that support our strategy, ensuring they are embedded within our culture and drive our actions

- Establish Zenith as a thought leader in the transition to zero emissions vehicles.

2. Grow the funded fleet and its recurring revenue

- Delivering a one-stop-shop solution for multi-asset fleets delivering a ‘best-in-class’ proposition

- Win more company car, LCV and salary sacrifice business by leading the sector in the transition to electric

- Grow our HGV and specialist vehicle business in our Commercial division, including ongoing growth in the trailer rental market

- Grow our B2C offering via the ZenAuto and ElectricAuto channels.

3. Grow ancillary, non-risk revenue

- Retain existing long term contracts and secure and implement new, large fleet customers

- Build our Commercial vehicle fleet management capabilities and drive new revenue from mobile technical capacity and workshops.

4. Deliver a single, multi- asset management tech platform, on a scalable basis

- Develop our leading technology capabilities further, to deliver operating and customer-centric platforms that support fleet growth, diversity and business growth.

5. Deliver a funding structure that is stable, scalable and competitive

- Implement funding facilities that are competitive and scalable for future fleet growth across all divisions

6. Attract, engage and develop our people

- Develop our employee proposition, including our “agile working” programme

- Enhance the capability and performance of our people through an industry leading talent offer

- Enhance our colleague experience through a winning and inclusive culture

- Achieve and maintain Sunday Times Top 100 Best Companies status.

Employees

We are committed to retaining and developing our employees.

As recognition of our achievements, Zenith has been listed in the following ‘Sunday Times Best Companies’ results for 2021:

- As a two-star Best Companies accredited business based on employee feedback for the year;

- In the Top 20 best companies to work for in Business Services sector; and

- In the 75 best companies to work for in Yorkshire & the Humber.

The Group has a very active employee engagement programme, of which we are immensely proud.

Zenith’s Academy provides learning and development opportunities to all our people. All employees have access to the Zenith Academy which has provided a broad range of training from finance and marketing to MBA, leadership and coaching courses.

We support our employees through all aspects of their journey with us from our award-winning induction programme to BVRLA industry courses and coffee mornings for new and expectant parents.

Zenith is committed to developing future talent through apprenticeships, as shown through the continued expansion and success of our apprenticeship programme. Through the period, we won several awards for our apprenticeship programme including the Princess Royal Training Award. We were also ranked in the UK’s top 100 Apprenticeship Employers in the National Apprenticeship Awards. In addition we are participating in the government’s Kickstart scheme to provide new jobs for 16-24 years olds who are at risk of long-term unemployment.

We have continued to run our Women in Leadership programmes this year which we are proud to be supporting.

Our employees’ health could not be more important to us. We have an in-house GP and have over 40 employees across all levels of the organisation who are trained mental health first aiders.

We recognise that a diverse and inclusive workforce will bring a wealth of experience, skills and ideas to the company. We know that an inclusive environment is a place where teamwork and co-operation thrive resulting in a more productive workforce. We are committed to promoting inclusivity, equality and diversity in everything that we do, be that procedures, policies or practice. We are proud to have a Diversity and Inclusion Committee made up of employees from across the business, at all levels, who have a genuine passion to ensure that inclusion and diversity are at the forefront of minds.

Environment and Corporate Social Responsibility (CSR)

Zenith is committed to ensuring that its business practices have positive impacts on the community and the environment.

Zenith is dedicated to maintaining high ethical and moral standards and to ensuring that we act in accordance with responsible social behaviour.

The three core objectives of our Environmental and CSR policy are:

- To sustain the environment;

- To conduct our business in an ethical and responsible manner; and

- To support the community, both locally and within our industry sector.

At Zenith we regularly hold fundraising events for charitable causes. Despite the challenges of COVID-19 and the multiple lockdowns during the year, we have continued our support for these events, such as supporting Macmillan’s coffee morning.

The following pages set out our actions and commitments to ensure that we lead our industry in delivering our environmental and CSR responsibilities.

Environment

We have established an ESG committee to support the delivery of the Group’s ESG strategy. One of the key objectives of the committee is to achieve our vision of transitioning the existing funded fleet to carbon neutral by 2030. The core strategy is to deliver both an ESG and a decarbonisation roadmap which are measurable, transparent and which establish Zenith as ‘best in class’.

In addition, our ESG strategy includes carbon-offsetting and gained carbon neutral certification in July 2021. We are working with the science based targets initiative (SBTi) to ensure we reduce our relevant emissions and provide a framework so our suppliers and partners can do likewise.

As part of our range of services for customers, Zenith provides advice and technical information to encourage our customers to promote and incorporate the most environmentally friendly vehicles and practice within their core fleet policies. On behalf of our customers, our consultancy team:

- Introduces customer plans to transition to cleaner fuel types by assessing daily travel requirements compared with the electric vehicle range of available and planned future car and van releases;

- Helps customers to develop driver policies on the usage of electric vehicles that include eligibility and in-use responsibilities such as charging provisions;

- Makes it easier for drivers and consumers to move to electric vehicles by offering support with installing charge points through the utilisation of partnerships; and

- Evolves and develops propositions to remove the barriers for electric cars such as unrestricted trade-ups.

In terms of direct emissions, Zenith plans to switch its own company car fleet to 100% EV by 2025, five years ahead of the target date for the wider, funded fleet. Our Kirkstall Forge office, which is part of a multi-tenanted building, saw 80% of the waste at the site recycled in the last year.

The table below includes our mandatory reporting of greenhouse gas emissions based on the new energy and carbon reporting framework. This is based on the Group’s greenhouse gas emissions for the year 1 April 2020 to 31 March 2021, covering both our office sites (in Leeds and Solihull, though the latter was recently closed) and business mileage travelled by our employees.

Our methodology used to calculate our emissions is based on the ‘Environmental Reporting Guidelines: including mandatory greenhouse gas emissions reporting guidance’ issued by the Department for Business, Energy & Industrial Strategy (BEIS) and Department for Environment, Food & Rural Affairs (DEFRA).

Emissions from purchased electricity includes emissions from business mileage travelled in electric vehicles. There has been a substantial reduction in our carbon emissions during the year, largely as a result of lower energy usage in our offices and reduced business travel, a consequence of the COVID-19 lockdowns.

Community

Zenith aims to ensure that we support our local community and integrate our business values and operations to meet the expectations of our customers and the wider public. We understand that we have an impact on the communities in which we operate, and employees are encouraged to assist the local community. We have established a CSR focus group to develop and promote our CSR policy.

Zenith works with Leeds Ahead to take part in voluntary community focused projects, to assist with the social and economic regeneration of Leeds, including the opportunity to support students in a local school.

Each year our employees select a ‘charity of the year’ which our fundraising efforts through the year support. In this financial year, our chosen charities were Leeds Mind and Birmingham Children’s Hospital.

We also encourage employees in their charitable endeavours such as supporting fund-raising events for colleagues and individuals.

We are delighted by the effort our people put into this and are encouraged by the feedback we receive from them in terms of the benefits they derive personally from being involved in these programmes.

Ethics

Zenith believes strongly in the need for ethics in business and to have ethical practices and transparency in all our activities as well as those of our suppliers. These principles strongly reflect the values of the Company.

Zenith believes we have a responsibility in the market with key issues such as:

- To treat our customers with respect and fairness and act true to our values;

- To treat our partners and suppliers fairly and to establish long-term relationships that deliver value and high service levels to our end customers;

- To promote within the market the need for awareness of our industry’s environmental impact on carbon emissions and to work closely with specialists to ensure that we are promoting carbon reduction strategies;

- To work closely with government and HMRC to ensure that we provide consistency and clarity to avoid either confusion or additional administrative costs for our customers; and

- To deliver our services through professional and trained personnel whose mandate is to exceed the clients expected level of service delivery. Our values are innovation, passion, agility, pride, drive and honesty.

Tax and HMRC

At Zenith we are proud of our service and ethics. Honesty is one of our core values and we apply this to our tax affairs and our dealings with tax authorities and tax advisors, in the same way we apply it to all our business activities.

We are committed to paying all the taxes that we owe, in accordance with the tax laws that apply to our operations. The way we report our tax affairs reflects the economic reality of the transactions we actually undertake in the course of our trade. Ultimately, we seek to pay the appropriate tax, at the right rate and at the right time. We believe that paying our taxes in this way is the clearest indication we can give of us being responsible participants in society.

We have built long-term relationships with our tax advisors and discuss with them new products and services to ensure the correct tax treatment is adopted. Our advisors also keep us updated on tax law as it evolves.

We respond to requests and enquiries from HMRC in an open, timely and professional manner. Where the tax treatment or reporting requirements of specific items are unclear, we always seek professional advice. The senior accounting officer and chief financial officer are involved in all these discussions.

Equality

The Company is committed to promoting equality of opportunity and it’s the Group’s policy that there should be no discrimination, harassment or victimisation of any employee, job applicant, customer, service provider or member of the public because of one of the following protected characteristics: age, disability, gender reassignment, marital or civil partnership status, pregnancy and maternity, race, religion or belief, sex or sexual orientation.

The Company has three main objectives:

- To encourage its employees to take an active role in combating all forms of unlawful discrimination, harassment and victimisation;

- To deter employees from participating in any such unlawful behaviour; and

- To demonstrate to all employees that they can rely upon the Company’s support in cases of unlawful discrimination, harassment or victimisation at work.

The Group is fully committed to providing, so far as is practicable, a good and harmonious working environment that offers equal treatment and opportunities for all its employees and where every employee is treated with appropriate respect and dignity.

Human rights and Modern Slavery

Zenith recognises the right of every individual to liberty, freedom of association and personal safety and observes internationally recognised standards set out in the UN Universal Declaration of Human Rights and the International Labour Organisation (ILO) Conventions.

Zenith has a long-standing commitment to conducting business ethically and the prevention of slavery and human trafficking is an important part of that commitment. We take steps to ensure slavery and human trafficking are not taking place either in our organisation or our supply chain, with our policy being underpinned and supported by the following:

- A collaborative approach with our supply chain, which encourages transparency. We provide appropriate support, guidance and monitoring to tackle any reported issue. Serious or repeated violations may result in a termination of supply, reduced volume of business or non-inclusion in future tenders;

- Annual training for key stakeholders within Zenith;

- A supplier lifecycle and procurement policy incorporating pre-contractual supplier due diligence, comprehensive contractual agreements and periodic review;

- Supplier Code of Conduct;

- Annual risk assessment of the supply chain

- Whistleblowing procedures and a contractual requirement for direct suppliers to our operational business to monitor compliance and report any matters of concern;

- A third-party governance, risk and compliance (GRC) software system

- A Supplier Governance and Risk Forum responsible for supply chain risk management and reviewing legislation and regulation changes that may impact Zenith’s business or supply chain. These responsibilities for the forum include Modern Slavery.

Gender Pay

Click here for Zenith’s Gender Pay Gap report.

Stakeholder engagement

The Directors are aware of their duty under s.172 of the Companies Act 2006 to act in the way which they consider, in good faith, would be most likely to promote the success of the Company for the benefit of its members as a whole and, in doing so, to have regard (amongst other matters) to:

- the likely consequences of any decision in the long term;

- the interests of the Company’s employees;

- the need to foster the Company’s business relationships with suppliers, customers and others;

- the impact of the Company’s operations on the community and the environment;

- the desirability of the Company maintaining a reputation for high standards of business conduct; and

- the need to act fairly between members of the Company.

The below section acts as our Section 172(1) statement. It lists our key stakeholder groups, their priorities, how we engage with them and actions the Board has taken following feedback, to promote the success of the Company for the benefit of its members as a whole.

Our customers – as a service-centric business our customers are at the centre of our decisions. Our customers expect a best-in-class service from us, which we aim to deliver. With dedicated contacts for our commercial fleets, extensive customer care resources for consumers, and a business structured around our services we can meet our customer needs, be that at a fleet manager level or an individual driver. As one of our non-financial KPIs, customer satisfaction is reviewed by the Board monthly. Linking this measure into our employee bonus scheme ensures customer satisfaction is considered in our employee’s actions and is at the forefront of our decision-making. This focus on our customers has led us to win the FN50 Customer Service Individual award and be highly commended in the Great British Fleet Awards for our Innovation in Customer Service in the past two years.

Our employees – to deliver our excellent service levels, the company relies on its dedicated team of employees. Our colleagues value roles in which they can learn and develop, a competitive benefits package, as well as a diverse, inclusive and safe environment in which to work. We engage with our employees across a number of platforms including our annual employee survey. We run programmes to support our colleagues across the organisation including our apprenticeship programme. We offer courses which encourage diversity including our women in leadership course and offer various wellbeing tools.

Our suppliers – a high-quality product is desired from our suppliers to match our service. Our key suppliers range across car dealerships, vehicle and parts manufacturers, short-term rental providers, garages and vehicle recovery providers, amongst others. By working closely with our suppliers, with direct engagement through our specialist relationship teams, we ensure our high service levels are maintained whilst charging a fair price to our customers, working together with our suppliers as trusted partners to achieve mutual success.

Our community and environment – we aim to keep our communities mobile and safe. A decision was made by the Board to set a new target to transition 100% of our own company car fleet to electric vehicles by 2025. Further information on our interactions in our communities and environment can be found within the Corporate Social Responsibility section of the Strategic Report.

Our funding providers – our funders are updated on our financial performance through weekly and monthly reports. When making credit decisions in the business, both at the approval stage of a contract and during the life we take a composed approach, balancing the risk with the requirements of the customer.

Our owners – our owners are highly supportive of well-considered investment decisions which will help us achieve desired growth in our business and ultimately enable a return on investment. Employee engagement in the performance of the business is encouraged through the employee share scheme. Both the management team and Bridgepoint have representation on the Board so are involved in decisions being made. Our vision and strategic priorities are set to enable us to achieve our growth requirements whilst balancing this with the requirements of our other key stakeholders.

Net debt & covenants

On 31 March 2021, the Group was funded by the following facilities:

- External, term bank debt of £434m. This is repayable on 31 March 2024.

- External Loan Notes of £289m (held in Zeus Finco Limited) and Preference Shares of £272m (held in Zenith Automotive Holdings Limited). These are owned by the shareholders of Zenith. Interest is calculated monthly and annually rolled and added onto the balance rather than being cash-settled. These instruments will be repaid in the event of a sale of the Group or after a 20-year period ending 31 March 2037.

- Cash and cash equivalents of £19m.

- The Group also has a Revolving Credit Facility (RCF) of £60m available until 31 March 2023. At 31 March 2021 £20m was drawn on this facility. There is a leverage covenant which is measured once the RCF is more than 35% drawn and we must ensure that when tested the Consolidated Super Senior Secured Leverage Ratio* does not exceed 1.65:1.

- Excluding shareholder debt, the Group has net debt of £435m as at 31 March 2021.

* Consolidated Super Senior Secured Leverage Ratio is defined as drawn RCF divided by EBITDA.

Capital structure

As set out in the section above, the Group has £434m of external debt. The loan notes and preference shares total £561m and are held by the equity shareholders, including both Bridgepoint and Zenith employees.

This type of capital structure, with a mix of external and shareholder debt and wide employee share ownership, has been successful in supporting the growth of the business through six private equity transactions and ensuring high levels of employee engagement in the business.

Principal risks and uncertainties

The following are the principal risk areas in the business:

Residual value risk is the possibility that a lease asset (in this case, a vehicle) can only be resold or re-leased at a price below the asset's residual value.

Zenith continues to respond to the COVID-19 threat. Existing defences and controls were employed as our workforce transitioned to a homeworking environment.

Approximately 75% of our contracted units have fixed price maintenance contracts. The customer pays monthly in fixed instalments over the life of the lease to maintain the vehicle. On 22% of these contracts the customer or manufacturer retain the risk. On the remaining contracts, Zenith retains the risk of maintenance costs being higher than maintenance rentals collected.

Zenith takes credit risk on customers to the extent it funds vehicles on either back-to-back or securitisation funding.

Zenith perform regular cash analysis to understand cash requirements and ensure the group can access sufficient cash resources to meet our funding requirements and meet liabilities as they fall due.

Zenith assumes regulatory compliance responsibilities in two main areas: within our consumer business, in business process outsourcing and in ZenAuto, where we undertake regulated activities, and within our corporate business in employee car ownership schemes. This exposes the group to regulatory compliance risk, particularly where regulations alter, or the group’s activities alter, and the business needs to respond with changes to systems or processes.

Key performance indicators

The directors use a series of financial and non-financial Key Performance Indicators (KPIs) to monitor the performance of the business.

We have chosen not to disclose certain non-financial KPIs which we believe are commercially sensitive. In all other aspects the Directors consider the annual report and financial statements comply with the Guidelines for Disclosure and Transparency in Private Equity.

COVID-19

The Group’s crisis management team started monitoring COVID-19 in January 2020. This prompt and thorough approach meant we were able to move to work from home a full two weeks before the UK Government imposed the first nationwide lockdown in the UK in March 2020 and that we could do so with minimal disruption or downtime in our systems or productivity. In the year to 31 March 2021, restrictions of varying severity were in place, including two further national lockdowns.

The professional and diligent approach of our managers across a period of years has resulted in excellent and robust business continuity plans. This has helped us to enable our workforce to work efficiently from home during the year, keeping our employees safe whilst also providing a high level of service to our customers. Whilst the country was in lockdown we experienced a decrease in our call volumes and resultant work load. As a result we utilised the government’s furlough scheme to support employees we did not require during this period. We continued to pay all our employees 100% of salary during this time. In line with the ‘roadmap’ published by the UK Government, we are implementing a phased return to the office, together with an “agile” approach to our working environment.

At the beginning of the first lockdown, covenants relating to the Group’s asset finance facilities were temporarily renegotiated to support corporate customer payment holiday requests and to implement the FCA guidance on providing consumers with payment deferral options. To date there have been minimal defaults in our portfolios and performance has been broadly in line with pre-COVID-19 levels

At the same time, in the very early stages of the pandemic’s onset the Revolving Credit Facility was fully drawn as a precaution to proactively manage liquidity and strengthen the group cash position. The RCF was subsequently reduced to its current level as liquidity was not at any time stretched and it became clear that this was no longer required. The Group also exercised its senior debt facility arrangements to suspend the interest coupon for one quarter (which rolled-up into the principal), also as a precaution to protect the balance sheet amongst the uncertainty brought by lockdown restrictions. We also utilised the UK Government’s VAT payment deferral scheme.

During the lockdown periods, the HGV business fulfilled its business-critical services, meeting increased demand from supermarkets, logistics and home delivery customer. The car and van division supported customers moving vehicle renewals into extension, continued to service its corporate customers and maintained order take.

All strategic initiatives have progressed, notwithstanding the circumstances, new business prospecting has continued, and the fleet is continuing to grow. Due to the nature of our business model, which is predominately leases of between three to five years to large corporate customers, the degree of visibility over our future earnings is high. We believe our success during the pandemic is a direct result of our robust strategy to diversify our group and that Zenith is well positioned to navigate any further periods of disruption caused by the COVID-19 pandemic.

Going concern

The Company makes use of bank facilities agreed on a Group-wide basis.

The Group has considerable financial resources to manage its operations, cash balances, headroom on its RCF and other day-to-day debt funding facilities and are compliant with our covenants (as noted in the net debt and covenants section above) with bank facilities repayable in March 2023 and 2024.

Following the year end, we have rearranged and significantly extended the securitisation facilities of the Group, which provide the bulk of our vehicle funding to customers in our corporate and consumer businesses. These new facilities enable us to expand our fleet and to create attractive opportunities for future growth across all of our divisions. The new securitisation facilities are on commercially attractive terms..

The Directors note that the Group is cash generative and have reviewed the forecasts which cover a period exceeding 12 months from the date of signature of the financial statements. This includes modelling of several scenarios, some directly or indirectly linked to the impact of COVID-19 on our markets. Under all of these scenarios the group maintains sufficient liquidity and covenant headroom.

On this basis, the Directors have a reasonable expectation that the Group and the Company has adequate resources to continue in operational existence for the foreseeable future. Thus they continue to adopt the going concern basis in preparing the annual financial statements.

Business review

Trading performance

In the year ended 31 March 2021, excluding the results of our emerging ZenAuto business, the Group delivered EBITDA* of £61.5m, up £3.2m, or 5.4% on the previous year. After incorporating ZenAuto, our statutory EBITDA was £58.1m (year ended 31 March 2020: £56.1m), an increase of £2.0m or 3.4%.

Statutory operating profit for the year was £1.3m (2020: £1.5m), after taking into account depreciation, amortisation of intangibles and goodwill and exceptional items.

The key drivers of growth in the year were a result of our resilient business model: high levels of recurring income, diversified and robust income streams and counter-cyclical elements of our earnings. This included increases in residual value profits (after the tightening of the used vehicle market, beginning during the first lockdown) and the flex of the fleet within our Corporate division into extended terms, as customers chose to prolong their lease agreements rather than renew.

An additional positive factor was the contribution of the former Cartwright businesses that now form our Commercial Vehicles Fleet Services and Commercial Vehicles Rentals businesses. Zenith incorporated these businesses on the acquisition of the fleet services and rental operations of the Cartwright Group in September 2020. We were particularly pleased by the performance of these businesses during the period after acquisition, and to welcome approximately 280 new colleagues to the group as a result of the acquisition.

Other parts of our group suffered from the consequences of the lockdowns and their impact on consumer behaviour and patterns of demand: namely, our business process outsourcing and short-term rental businesses. However, the downturn in the market for these divisions has since reversed after the lockdowns were lifted early into the new financial year and current trading is positive.

ZenAuto, our consumer brand, has continued to increase its fleet numbers and develop its business resources strongly during the year.

With continued investment in our people, IT and marketing, ZenAuto contributed a loss of £3.4m to EBITDA (£2.2m loss in previous year), which was in line with our expectations as we invest to increase the scale and capacity of the business.

Net result

Because of the Group’s structure, and the impact of acquisition accounting, despite EBITDA of £58.1m, the Group reported a loss after tax for the year of £99m (2020: £102m). This was a result of deducting non-cash items of £50m for amortisation of goodwill and intangibles (non-cash, acquisition accounting matters), and preference share and loan note interest of £63m (also non-cash items). The preference shares and loan notes are owned by the shareholders and not paid in cash until the instruments are redeemed. The Group is cash generative and is forecast to continue to be so for the foreseeable future.

Balance sheet, funding and liquidity

The Group balance sheet shows total assets of £1,581m (2020: £1,545m) including cash balances of £19m (2020: £74m, after drawing £60m on the Group’s RCF).

We have a large and diversified pool of asset finance facilities available to us, to finance our leasing operations, which includes a significant element of committed facilities, and we have plenty of headroom with which to fund our ambitious growth plans. Our securitisation facilities, recently rearranged and extended, provide us with competitively-priced capital and sufficient firepower with which to develop our business across our corporate, commercial and consumer businesses.

Summary and outlook

The past year has possibly been the most challenging environment we have operated in since the creation of Zenith, not just for trading conditions, but for the impact on our employees, customers and partners. However, we are confident that our business model, our range of services and demand for vehicle mobility in general will be central to everybody’s lives in future as restrictions imposed by the UK Government are lifted and the UK economy continues to recover from the effects of COVID-19 and the resulting lockdowns.

Our view is that the fundamental growth drivers of the market remain highly positive:

We are increasingly able to differentiate our service proposition helping us secure prominent new business and the Directors are confident that the Group can continue.

We are stable and well organised to capture market share across both corporate and consumer markets. We have some of the best-connected technology available and a highly experienced, agile, engaged team that is committed to continuing Zenith’s future success.

This Strategic Report has been approved by the Board and signed on its behalf by:

M T Phillips

Chief Financial Officer

27 August 2021

* EBITDA is defined as operating profit before amortisation of goodwill, depreciation of tangible & intangible assets and exceptional items

For further information, view the Zenith Automotive Holdings Limited accounts on Companies House, or click here